Women in the United States have more spending power and influence over household budgets today than ever before.

Yet, new data shows that women report higher levels of financial stress than men, which negatively impacts their wellbeing.

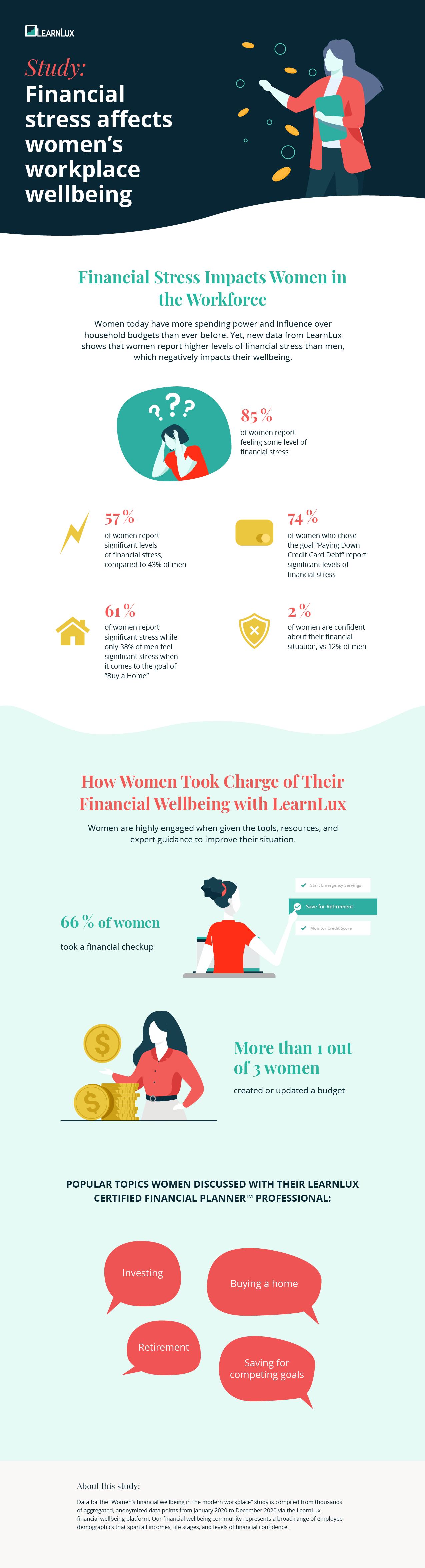

According to a recent study by LearnLux surveying participants in their workplace financial wellbeing program, 85% of women report feeling some level of financial stress.

This number is staggering, and has real impacts in the modern workplace.

Employees who report financial stress incur higher healthcare costs, are more likely to leave their current job for a nominal pay raise, and experience increased absenteeism and presenteeism.

The good news? Women are likely to take action to improve their financial situation when given the right resources and tools.

The same study showed that when offered LearnLux as an employee benefit:

- 66% of women took a financial checkup

- More than 1 out of 3 women created or updated a budget

- Women took calls with Certified Financial Planner™ professionals and discussed topics such as investing, buying a home, saving for competing goals and retirement readiness

About this study

The following study aggregates thousands of anonymized data points from the LearnLux financial wellbeing platform.

Our financial wellbeing community represents a broad range of employee demographics that span all incomes, life stages, and levels of financial confidence.

Explore the full financial wellbeing report

Ready to dive in? The infographic below summarizes the data from the LearnLux study.

Click here to launch the graphic in a new window.

Key takeaways

- Women in the workplace today suffer from extreme levels of financial stress

- However, women are highly engaged when given the tools, resources, and expert guidance to improve their situation

- Partnering with a trustworthy financial wellbeing provider can help drive the same results at your workplace

.png)