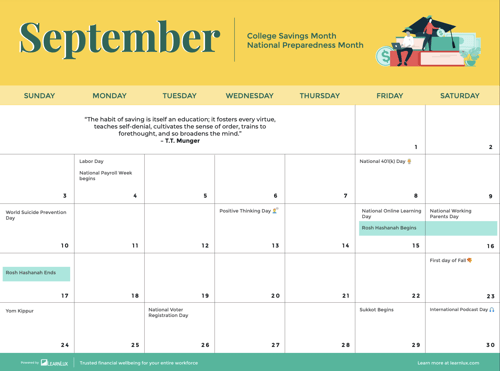

On Monday, many employees enjoyed a day off to celebrate their hard work on Labor Day. This week, employers can help their teams celebrate their future plans to take it easy in retirement — Friday, September 8th is National 401(k) day!

National 401(k) Day is important for employees because it serves as a reminder of the significance of retirement savings and encourages individuals to take proactive steps toward securing their financial future.

It highlights the value of employer-sponsored retirement plans and the opportunity they provide for long-term financial health and retirement readiness.

Why celebrate the 401(k)?

So, why celebrate the 401(k)? Many employees rate their retirement savings as "incredibly important" for their financial wellbeing.

More than 78 percent say a 401(k) will be their largest or only source of retirement income. Additionally, 86 percent of employees consider a 401(k) a “must-have” benefit and expect support from their employer.¹

However, only about half (52 percent) of individuals participating in retirement savings plans believe they are “on track.”²

How to recognize 401(k) day in the workplace

Your employee’s increasingly busy lives make it challenging to take time out and plan for the future, but 401(k) Day might just be the reminder we all need.

Consider meeting each employee where they are with your 401(k) day communications. Before contributing to their 401(k), some employees may prioritize paying down high interest debt, or establishing an emergency fund.

For employees who are already contributing, offer guidance around investment strategies based on their risk tolerance, or how to make the most of their employer match.

Financial wellbeing programs can supercharge your 401(k) strategy

Confidence starts with education, and financial wellbeing programs (like LearnLux that offer education & interactive tools as an employee benefit are a great way to start the conversation with your team.

When considering a financial wellbeing provider, look for programs that cover topics like:

- Retirement readiness strategies

- 401(k) Basics

- How to roll over an old 401(k) to your new employer

- IRA vs 401(k) - What's the difference?

- 401(k) Contribution Limits and Tax Advantages

- Should I pay off debt or save for retirement?

- 401(k) Investment Options and Vesting

- Leaving your Job, Access to 401(k) Funds, and 401(k) Loans

So, however you plan to celebrate National 401(k) Day with your employees, help them keep their sights set on the future. This will help them build the confidence they need to feel great about their personal finances. It will help them retire on time, have peace of mind, and have a better understanding their benefits too.

Sources: 1. Schwab Retirement Plans Survey 2. 401k Confident a Matter of Education not Resources