Take a look into your employee benefits crystal ball. What does the future of financial wellness hold? Our rapidly changing workplaces make planning a challenge, but industry trends can tell us a lot.

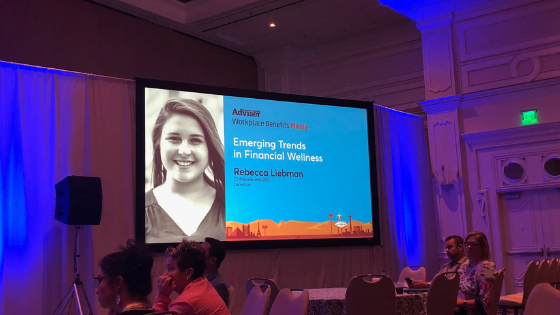

Rebecca Liebman, CEO of LearnLux recently took the stage at EBA’s Workplace Benefits Mania in Las Vegas to share her first-hand insights about what’s to come. Here are the top 5 trends highlighted in her session on Emerging Trends in Financial Wellness.

High tech, high touch experiences

While digital education builds a strong foundation, and interactive tech drives engagement, the human element of personal finance continues to play a key role. Emerging solutions that blend online learning with 1:1 guidance from financial planners are a top trend in financial wellness, and will soon be industry standard. According to PwC's recent Employee Wellness Survey, 57% of respondents report that they want to learn and plan at their own pace, but when it comes to taking action, they want an expert to validate their decisions. This puts high tech, high touch financial wellness at the forefront.

Independent Providers

There’s no place for bias in modern financial wellness. Historically, financial wellness programs were created, sponsored and sold by big financial institutions, served with a side of corporate agenda on commission. In the modern workplace, employee trust is everything, and plan sponsors are saying “no” to solutions that sell. HR managers and benefits professionals alike are starting to ask tough questions when evaluating providers, and settling for nothing less than 100% unbiased. Look for solutions like LearnLux that are crystal-clear about being independent and unaffiliated.

Impressive Personalization

For employees today, one size fits all just won’t cut it. Employers and employees alike expect information that’s timely, relevant and responsive. Innovative financial wellness programs will use data and AI to create custom experiences at scale, and content will be highly tailored to each organization’s benefits options. Employees have different confidence levels, risk tolerance, debt and target retirement dates, so their financial well-being plan should be as personal as their fingerprint.

Holistic Solutions

The future of financial wellness at work will be about connecting the dots in each employee’s financial life. Single issue programs that address student loans or credit scores miss the bigger picture, so holistic solutions are on the rise. Modern programs start by administering assessments to identify employee needs, and insights are used to create action plans to help each individual reach their goals. By caring for the whole employee with financial wellness, organizations can address deeper workplace challenges like motivation, productivity and absenteeism due to financial stress.

Pilot Programs

Modern workplaces will want to move fast to launch and learn from data, so financial wellness pilot programs are an emerging trend that will really take off. Pilots establish benchmarks and deliver insights quickly, which will help show a return on investment out of the gate. Companies will be on the lookout for financial wellness programs with simple, intuitive onboarding to accelerate time-to-launch speed even further.

---