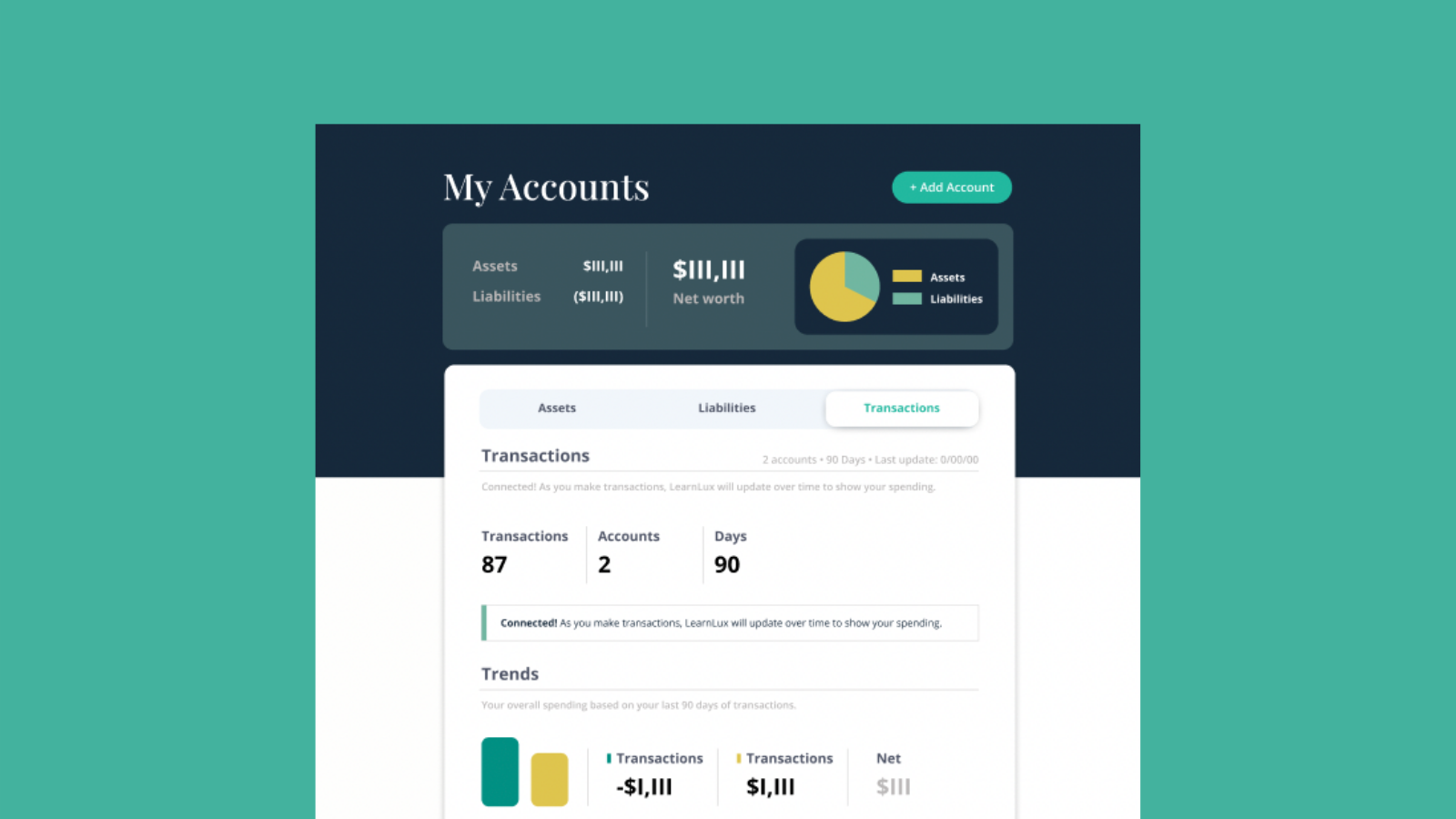

To empower LearnLux members to have real-time transparency into their spending, saving, assets, and liabilities, we are excited to offer the net worth and transaction insights feature.

Members can privately and securely connect their financial institutions to LearnLux, and gain real-time transparency into the balances, transactions, and trends on their financial accounts.

About net worth and transaction insights

Keeping track of your financial life can be a time-consuming task.

Many of us have trouble tracking what we own vs. what we owe across multiple savings and checking accounts, credit cards, mortgages, car payments, and retirement accounts.

This can make it challenging to stick to a financial plan, calculate net worth, reach big goals, and make key decisions around benefits, equity, and retirement.

Net worth and transaction insights is a powerful feature that allows you to privately and securely connect your financial institutions to LearnLux. This empowers you with real-time transparency into the balances, transactions, and trends on all of your financial accounts.

How does the LearnLux net worth and transaction insights feature work?

- Sync your bank accounts, credit cards, retirement accounts, and more with the net worth and transaction insights tool

- Choose from more than 11,000 accounts to link in just a few clicks

- Manually add assets and liabilities for accounts that can’t be linked or that you prefer not to connect

- Review your spending and savings, and see spending trends over multiple months of activity

- Member security and privacy are our top priority. All login information is encrypted, LearnLux cannot access or make changes to your accounts, and we will never share your data with your employer

How can net worth and transaction insights improve your financial wellbeing?

- See all of your accounts in one place

- See your net worth calculated in real-time

- Feel empowered to review your accounts to check for accuracies/discrepancies and monitor for suspicious activity or unexpected fees

- Allow LearnLux Planners to review your account balances for more efficient, accurate, and achievable guidance

- View transactions made on each of your accounts, and see an overview of your spending habits

Learn more about net worth and transaction insights

For more information about net worth and transaction insights, check out the FAQ here and request a demo of the LearnLux program here.