Money on your mind? You’re not alone. Money is the #1 worry for most Americans, even above career, family, or physical health.

When money worries become chronic, our mental health can really suffer. Lack of sleep, anxiety, depression, low self-esteem, paranoia, and hopelessness are all symptoms of poor financial health.

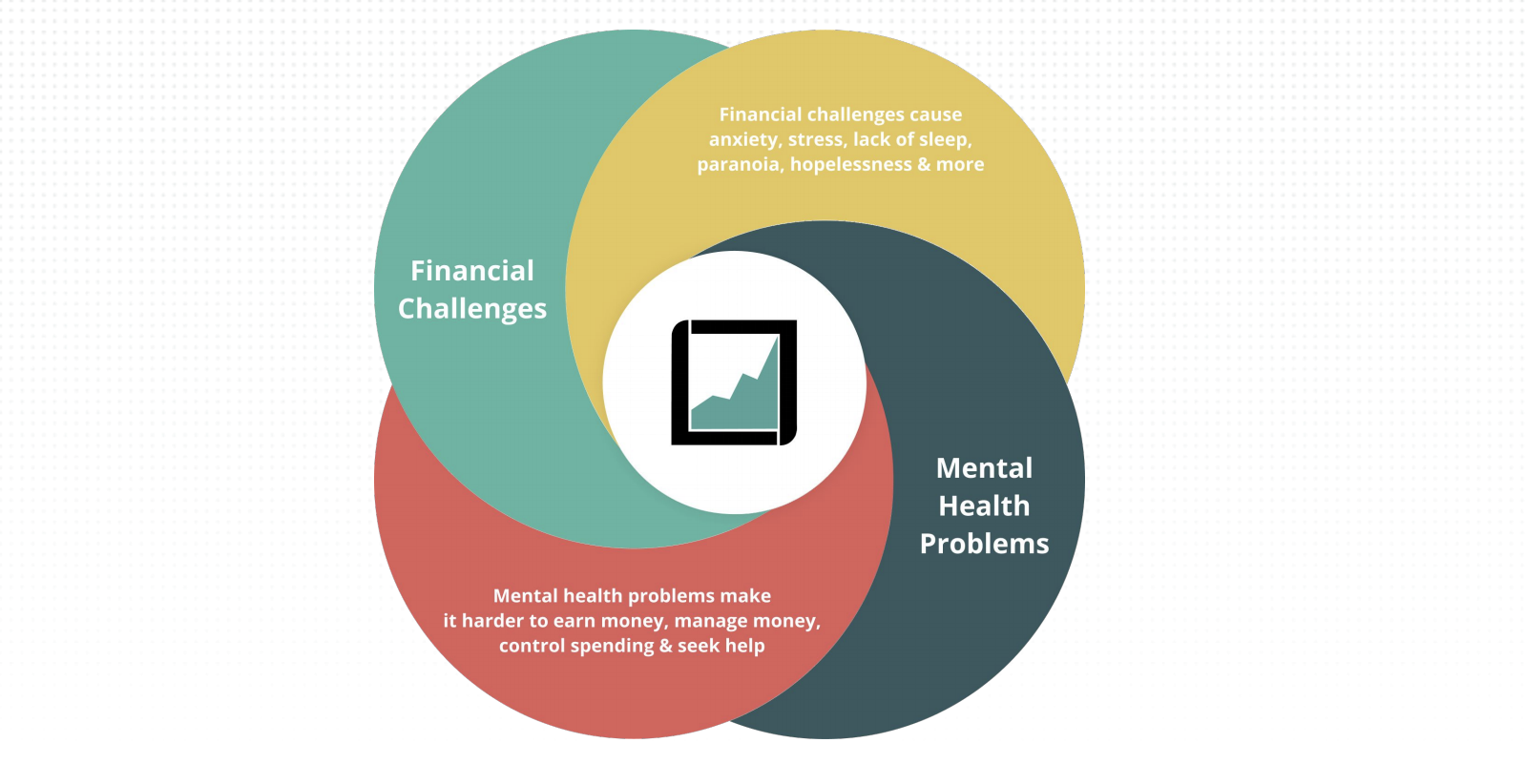

There’s no question that money and mental health are closely linked.

This is especially true in the workplace today, where the blend of home life and career makes leaving our problems behind virtually impossible.

Although employers have embraced mental and financial benefits, it’s time for their strategies to be more closely considered.

In The Mental Health and Money ebook, join us for a deep dive into the connection between financial health and overall wellbeing.

You’ll learn more about the effects of the money and stress spiral, then leave with actionable solutions and a clear path forward

The Mental Stress & Money Spiral

The link between mental and financial stress can be a vicious cycle.

Financial stress adversely impacts mental health. Poor mental health makes managing money a challenge. These difficulties result in worsening mental health and money problems, and so on.

Think of an employee going through a divorce who suffers a season of depression and financial loss.

- They must completely rebalance their budget and become anxious when they see that they will not be able to cover their expenses.

- Their mental state makes it hard to manage their finances and when a surprise expense pops up, they quickly turn to a predatory payday loan.

- Feeling totally out of control of their situation, they aren't sure where to turn and continue to silently suffer.

Or, imagine a team member who has anxiety about the dentist.

- They delay care so long that their next visit incurs a $4,500 bill

- This wipes out their emergency fund and adds to their growing credit card debt.

- Without a financial safety net, they suffer from anxiety and insomnia and wish they had a better financial plan.

These scenarios paint a clear picture of the experience an employee can have tomorrow, even if they’re mentally or financially “well” today. In the Mental Stress of Money ebook, we'll take a deeper look at some other effects of the mental stress and money spiral.

Who is the Mental Health and Money eBook for?

Benefits professionals & consultants looking to supercharge their wellbeing strategy during Mental Health Month and beyond.

In this eBook, you'll explore:

- The mental stress & money spiral

- Impacts of mental and financial stress

- Actionable solutions, and more

Click below to download a free PDF copy of the eBook to take with you.