How are your employees feeling, financially? With the state of our world today, many HR teams want to know, yet are hesitant to ask. Thankfully, PwC has your back with their annual Employee Financial Wellness Survey.

This comprehensive report tracks the financial wellbeing of full-time employed US adults. Typically, it highlights a range of results and trends. This year, they’re diving deep on stats that help employers understand the financial impacts of COVID-19.

For busy benefits professionals, there might not be time to absorb the full report. What comes next is PwC’s top 5 key stats at a glance.Use them to inform your workplace financial wellbeing strategy through this pandemic, and beyond.

With the time you saved, grab a cup of coffee and transfer a few dollars into your emergency fund (your future self will thank you for it).

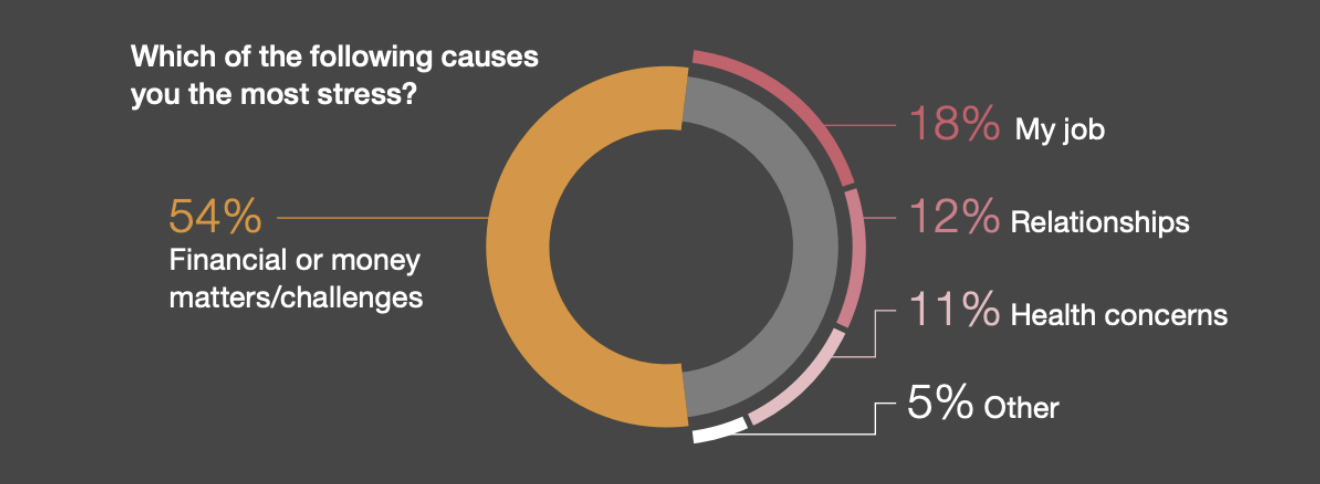

Financial challenges cause employees the most stress, by a landslide.

When asked, “What causes you the most stress?” 54% of employees say financial or money matters/challenges. 18% say their job causes the most stress, followed by 12% that say relationships, 11% reporting health concerns, and 5% that say “other.”

With financial challenges on the brain, your workforce is more distracted, less productive, and likely to experience physical & mental impacts of chronic stress. PwC highlights this stat as the #1 workplace issue to address, and for good reason.

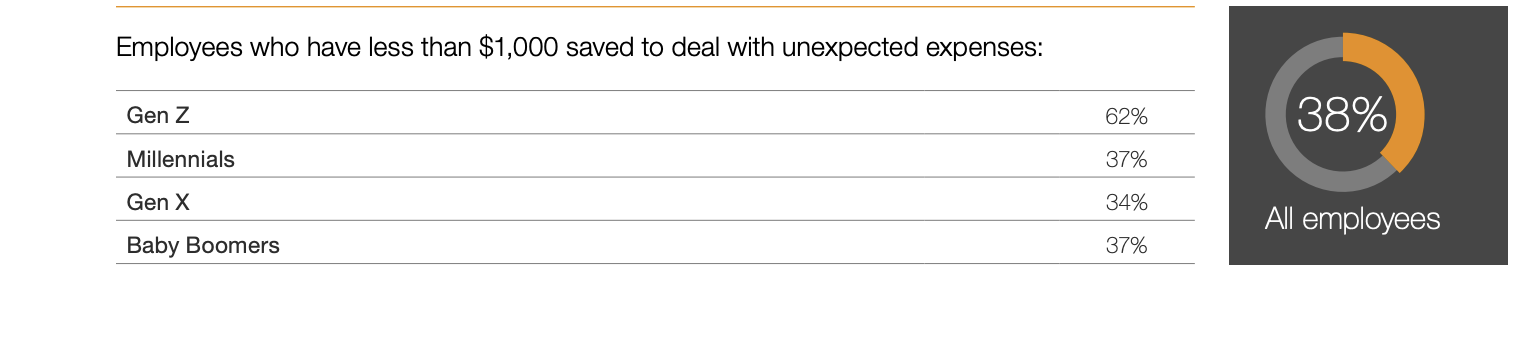

Nearly 40% of employees have less than $1000 saved for an emergency.

More than one-third of full time employed Millennials, Gen Xers, and Baby Boomers, and 62% of Gen Z have less than $1,000 saved to deal with unexpected expenses.

Women are at even greater risk; only half as many women as compared to men are able to meet basic expenses if out of work for an extended period. Without cash reserves to call on when times get tough, employees turn to expensive payday loans, consumer debt, and damaging decisions like taking money from their retirement funds. In fact...

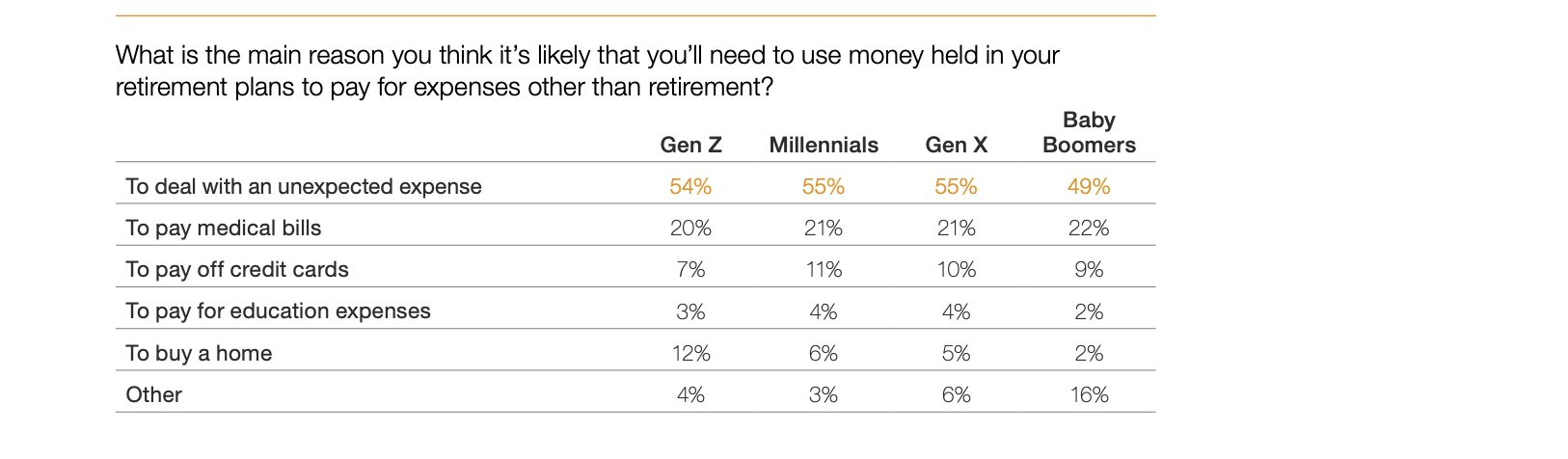

More than 50% of the American workforce expects to use money in their 401k for expenses other than retirement.

Employees told PwC it was very likely they would use money held in their retirement plans for something other than retirement.

The vast majority of employees across all age demographics reported that unexpected expenses or medical bills were the top reasons.

Selling retirement investments at a loss, locking in those losses, and missing out on the potential for future recovery and growth can have devastating impacts on employee’s financial health for decades to come.

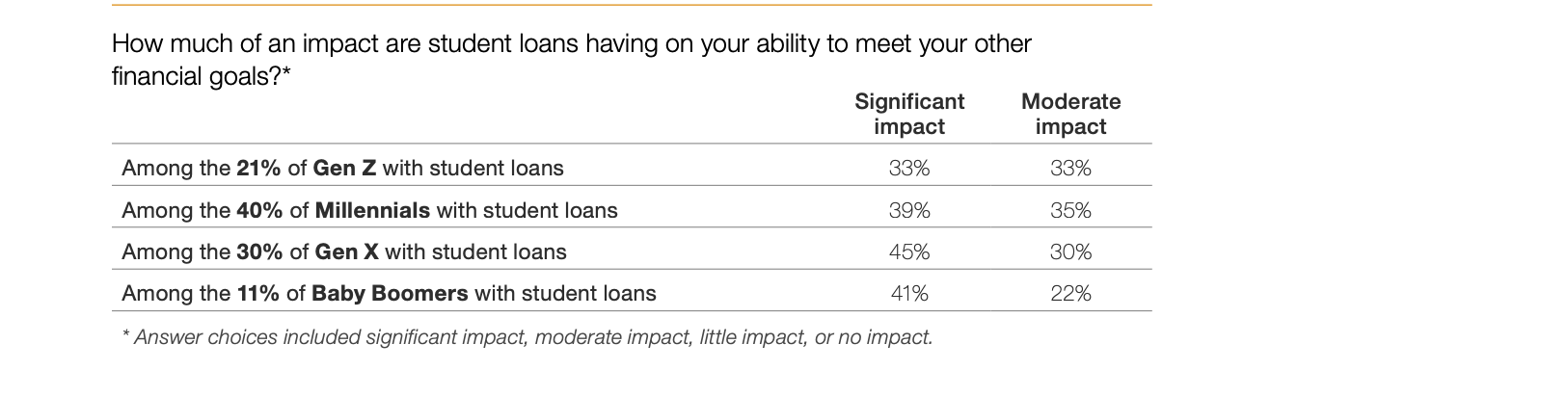

74% of Millennials say student loans have a moderate or significant impact on their ability to meet their other financial goals.

Student loans are a critical issue, during peaceful financial times and pandemics, too.

PwC's survey results find that 40% of Millennial employees have a student loan and nearly three-quarters of them say that student loans have a moderate or significant impact on their ability to meet other financial goals.

When employees have trouble meeting financial goals, they’re likely to quit for a minimal pay raise in an attempt to “earn” their way out of debt.

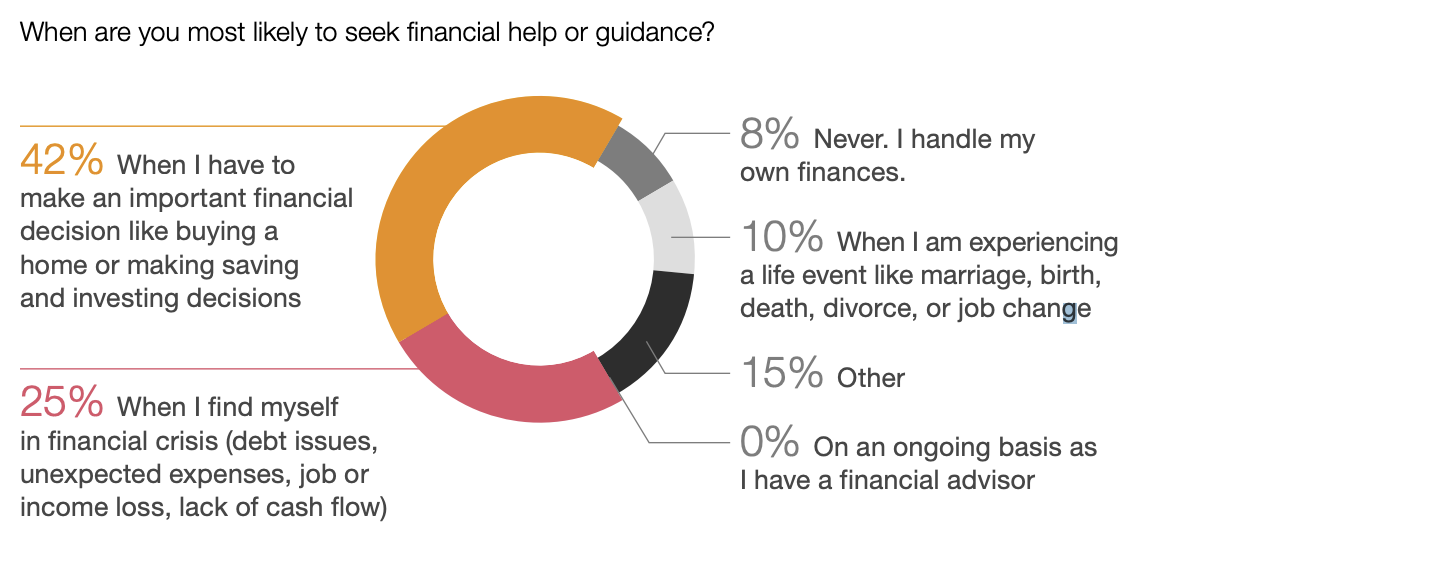

More than 2 out of 3 employees seek financial guidance at key decision points or when they’re already in crisis.

According to experts at PwC, employees will need guidance as they recover financially and strive to protect themselves from future financial issues.

Seeking financial guidance is an action that’s often reactive, rather than proactive. This is reflected in employee responses to the question, “When are you most likely to seek financial help or guidance?”

As many employees sink deeper into financial crisis, they find themselves unprepared to make big decisions. Employers should look at the pandemic as a unique forcing function to help employees think about their finances, and make smart choices as they navigate through the challenges to come.

---

So, what strategies can employers implement to improve these stats? PwC suggests supporting employees with financial education content and coaching to walk them through a systematic approach to achieve holistic wellbeing.

In the days, weeks, and months ahead, employees will need unbiased financial guidance and support to understand the variety of employer and government benefits available to meet their growing financial needs and rising concerns.

PwC notes that it’s not just a socially conscious response for employees reeling from the global pandemic, but it will likely benefit the company with a more appreciative workforce with greater financial resiliency and engagement.

About PwC's Survey

- PwC’s 9th annual Employee Financial Wellness Survey was conducted in January 2020 and tracks the financial and retirement well-being of working U.S. adults nationwide.

- This year it incorporates the views of 1,683 full-time employed adults. Participants have been categorized by generation using the following age groups: 18-23 (Gen Z), 24-38 (Millennials), 39 to 59 (Gen X), and 60 to 75 (Baby Boomers).

- Representation of these generations in the workforce is based upon Bureau of Labor Statistics.

- For the first time in the survey, PwC is reporting Gen Z results as they are the newest generation to enter the workforce.

- Citations of this survey report should read “PwC’s 9th annual Employee Financial Wellness Survey COVID-19 Update, PwC US, 2020.”